Harley Davidson Financial Analysis

It operates in two segments Motorcycles and Related Products and Financial Services.

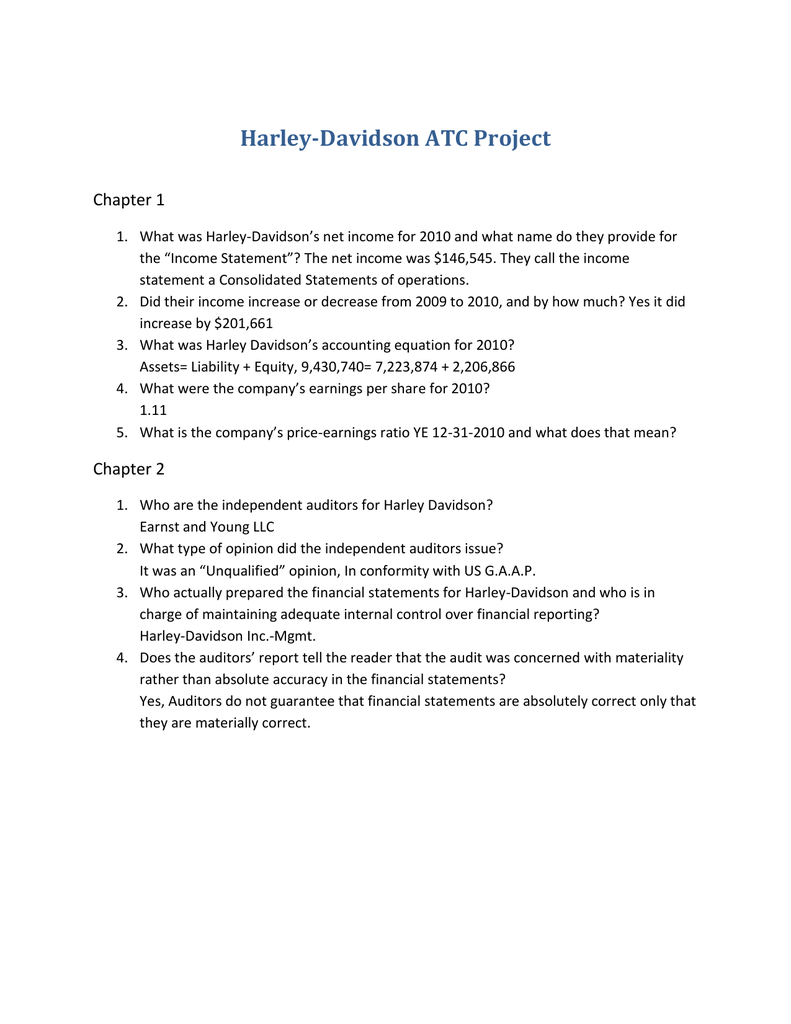

Harley davidson financial analysis. Income statements balance sheets cash flow statements and key ratios. Harley Davidson Financial and Strategic Analysis Review 989 Words 4 Pages. Harley-DavidsonInc known for its famous bar and shield trademark is based.

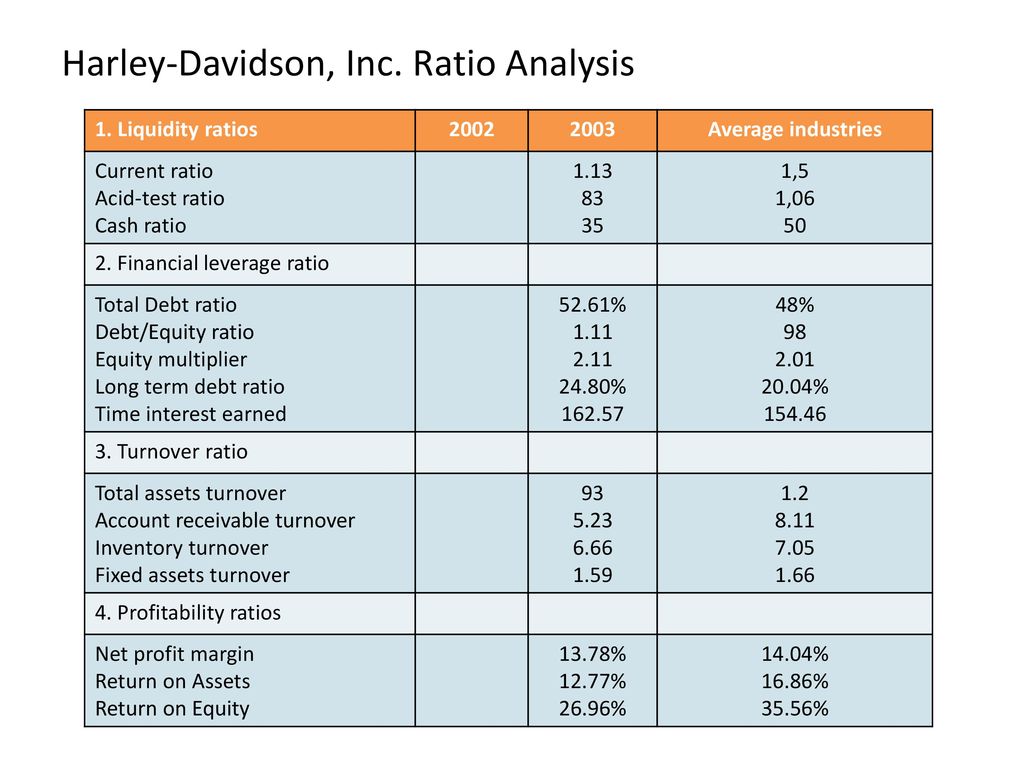

The need to expand globally is fueled by the companys financial situation. Engages in the production and sale of heavyweight motorcycles. According to these financial ratios Harley-Davidson Incs valuation is way above the market valuation of its sector.

The net profit of the company was USD 59911 million during the fiscal year 2011 an increase of 30883 over 2010. Saneya el GalalyPresented By. Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc.

Unit Non-Rating Action Commentary Wed 05 Oct 2005 Fitch Completes Release of Issuer Default Ratings for Automotive Automotive Parts Capital Goods Sectors. This first report focuses on strategy analysis and includes the following sections. Harley-Davidson manufactures heavyweight motorcycles as well as a complete line of parts apparel and accessories for motorcycles.

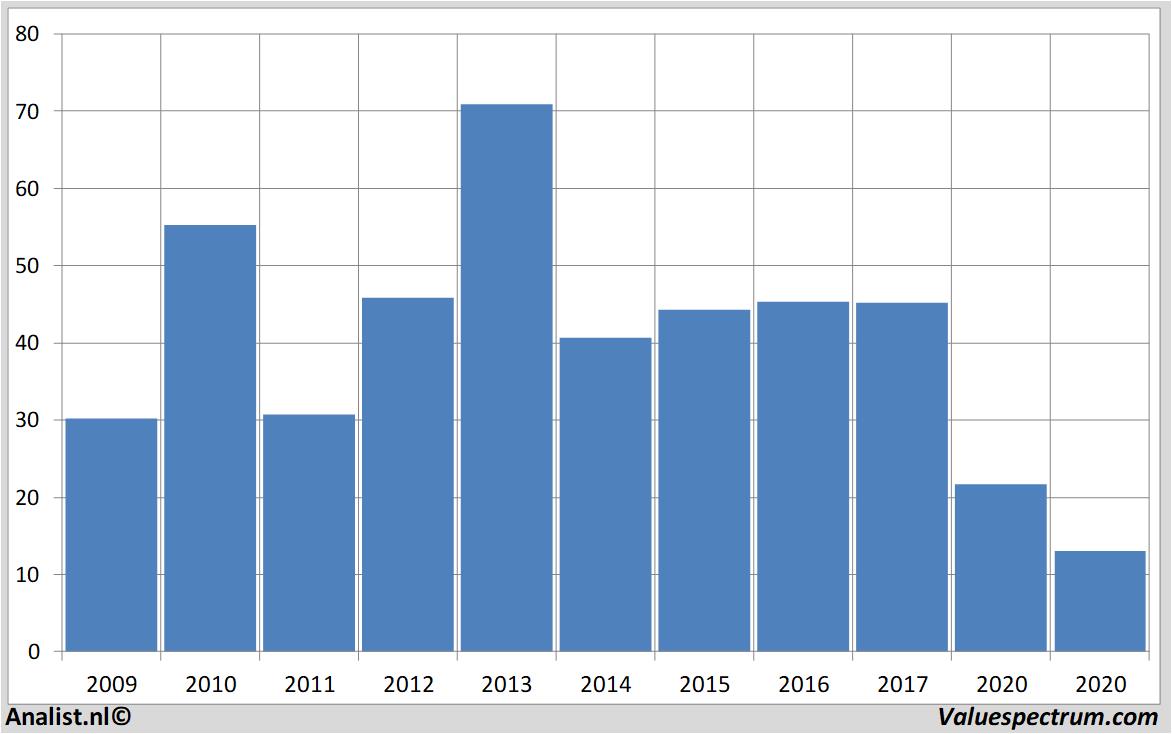

Is lower than its historical 5-year average. - Financial and Strategic Analysis Review Publication Date. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Harley-Davidson Incs.

The company markets its products in North America Europe AsiaPacific and Latin America. Mahmoud Abdel Hamid Karim Mohsen Mohamed Hossam Mohamed Madkour4092011 2 3. The Investor Relations website contains information about Harley-Davidson USAs business for stockholders potential investors and financial analysts.